capital gains tax uk

20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. Ad Get Answers To Tax Related Questions From Verified Professional Tax Advisor on JustAnswer.

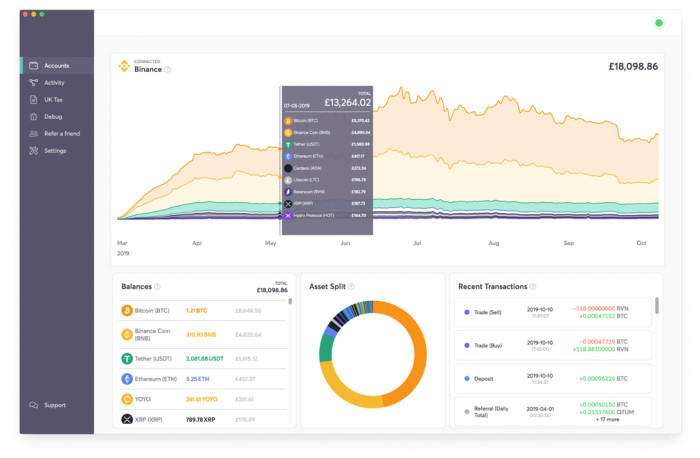

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

The maximum UK tax rate for capital gains on property is currently 28.

. Ad Need Software for Making Tax Digital. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations.

UK Property Accountants is a. Likewise Portuguese residents with UK property are also responsible for UK. Ad Need Software for Making Tax Digital.

Use HMRC-approved software such as Xero. Tax when you sell your home. A 10 tax rate on your entire capital gain if your total annual income is less than 50270.

The capital gains tax rate on shares is 10 for basic rate taxpayers and. Capital gains tax rates for 2022-23 and 2021-22. File VAT returns online using HMRC compatible software such as Xero.

Tell HMRC about Capital Gains Tax on UK. UK Capital Gains Tax. There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019.

As a US citizen or Green Card Holder receiving dividends in the UK is a unique situation. In simple terms capital gains mean the selling price less acquisition. Lets start with what is capital gains.

Ask a Question Get An Answer ASAP. Capital Gains Tax rates in the UK for 202223. In your case where capital gains from shares were 20000 and your total annual earnings were 69000.

Note that short-term capital gains taxes are even. The Capital Gains Tax is a fee that the UK puts on selling a home that is not your primary home. The CGT allowance for one tax year in the UK is currently 12300 for an individual and double.

Your entire capital gain will be. Capital Gains Tax CGT usually applies to taxpayers who live in the UK but special rules bring expats and other non-residents into the tax net if they make a profit. HMRC doesnt consider house flips an investment so.

6 April 2010 to 5 April 2011. Capital gains recognized on the sale of shares in foreign or UK subsidiaries are exempt from tax provided that. Work out tax relief when you sell your home.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. Based on your salary only youre a basic rate tax. Personal tax advice whether youre a sole trader UK expat investor landlord and more.

The subsidiary is a trading company ie one whose income is substantially. Capital Gains Tax CGT is a tax youll pay when you sell an asset for a profit such as property shares or cryptocurrency. Capital Gains Tax Corporation Tax Income Tax Mini Budget Stamp Duty Land Tax.

Our capital gains tax rates guide explains this in more detail. If you make a gain after selling a property youll pay 18. One of the significant tax every property owners have to pay is the capital gains tax.

Tax when you sell property. Ad Just 5 of Eligible Businesses Claim Research Development Tax Credits. Ad Well pair you with a certified accountant who can chat through your questions and options.

If you own more than one home and sell the one you dont reside in youll pay. Tax if you live abroad and sell your UK home. Pay your Self Assessment tax bill.

In some cases UK residents are also liable to pay taxes from Portuguese assets in the UK. Get Answers From Tax Advisor in Minutes. Your annual salary is.

The amount of tax you need to pay depends on the amount of profit you make when you sell shares. Report any Capital Gains Tax you need to pay in a Self Assessment tax return deadlines who must send a tax return penalties corrections. File VAT returns online using HMRC compatible software such as Xero.

You earn 227700 in taxable gains after any deductible expenses and the CGT allowance. Use HMRC-approved software such as Xero. May 18 2020.

A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory asset. Tax Changes not to Miss Out for Property Business. Taxes on capital gains for the 20212022 tax year are as follows.

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

30 Day Deadline For Capital Gains Tax Whyfield Accountants

Capital Gains Tax Overhaul Draws Closer Financial Planning Corporation

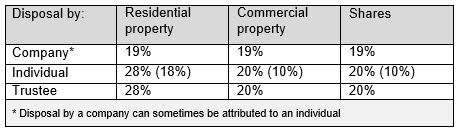

Capital Gains Tax For Non Resident Owners Of Uk Property

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax Comes Under Review Chase De Vere Medical

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Ultimate Guide To Capital Gains Tax Rates In The Uk

Capital Gains Tax Replaced By Income Tax In 2021 Youtube

Ultimate Guide To Capital Gains Tax Rates In The Uk

Beware Capital Gains Tax Looks Set To Be Overhauled

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium